Irs underpayment penalty calculator

This IRS penalty and interest calculator provides accurate calculations for the failure to file. Here are the rules.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Recommends that taxpayers consult with a tax professional.

. Now you can calculate the amount of the underpayment penalty. We may charge interest on a. Looking For IRS Help.

If you dont pay the amount shown as tax you owe on your return we calculate the Failure to Pay Penalty in this way. If you pay 90 or more of your total tax from the. Looking For IRS Help.

Taxpayers who dont meet their tax obligations may owe a penalty. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Calculating the underpayment IRS penaltybased on your income and tax liability is here.

Ad The IRS contacting you can be stressful. How We Calculate the Penalty In cases of negligence or disregard of the rules or regulations the Accuracy-Related Penalty is 20 of the portion of the underpayment of tax that. Ad Resolve your tax issues permanently.

The estimated tax safe harbor rule means that if you paid enough in tax you wont owe the estimated tax penalty. Generally most taxpayers will avoid this penalty if they either owe less than 1000 in tax after subtracting their withholding and refundable credits or if they paid withholding and. How We Calculate the Penalty We calculate the amount of the Underpayment of Estimated Tax by Corporations Penalty based on the tax shown on your original return or on a.

Calculate the penalty on the amount of the underpayment of each installment for the period of underpayment. Get Free Competing Quotes From IRS Tax Relief Experts. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

Failure to Pay Penalty This penalty is charged when you fail to pay your taxes by the due date. Underpayment of Estimated Tax Penalty Calculator. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Search for underpayment penalty Click the Jump to underpayment penalty link This will take you directly to the section of the program where you can review the. You owe less than 1000 in tax after subtracting your withholding and refundable credits or. Ad The IRS contacting you can be stressful.

Underpayment of Estimated Tax Penalty Calculator. Penalty is 5 of the total unpaid tax due for the first two months. To figure out your underpayment penalty use the IRS underpayment penalty calculator.

Ad Use our tax forgiveness calculator to estimate potential relief available. After two months 5 of the. Get free competing quotes from the best.

Dont Let the IRS Intimidate You. For payments that are less than 1250 the dishonored-check penalty is 25 or the. Ad Use our tax forgiveness calculator to estimate potential relief available.

We work with you and the IRS to resolve issues. The maximum total penalty for both failures is 475 225 late filing and 25 late payment of the tax. The safe harbor method allows you to avoid an underpayment penalty if.

You will owe 2 of the amount of the payment for any payments of 1250 or more. To avoid an underpayment penalty from the IRS you must pay at least 90 of the taxes owed for a given year or 100 of the liability from. The penalty rate for calendar year 2021 is 4167 per month or.

In order to use our free online IRS Interest Calculator simply enter how much tax it is that you owe without the addition of your penalties as interest is not charged on any outstanding penalties. If the delay in filing tax return is over 60 days late the minimum failure. IRS sets and publishes current and prior years interest rates quarterly for individuals and businesses to calculate interest on underpayment and overpayment balances.

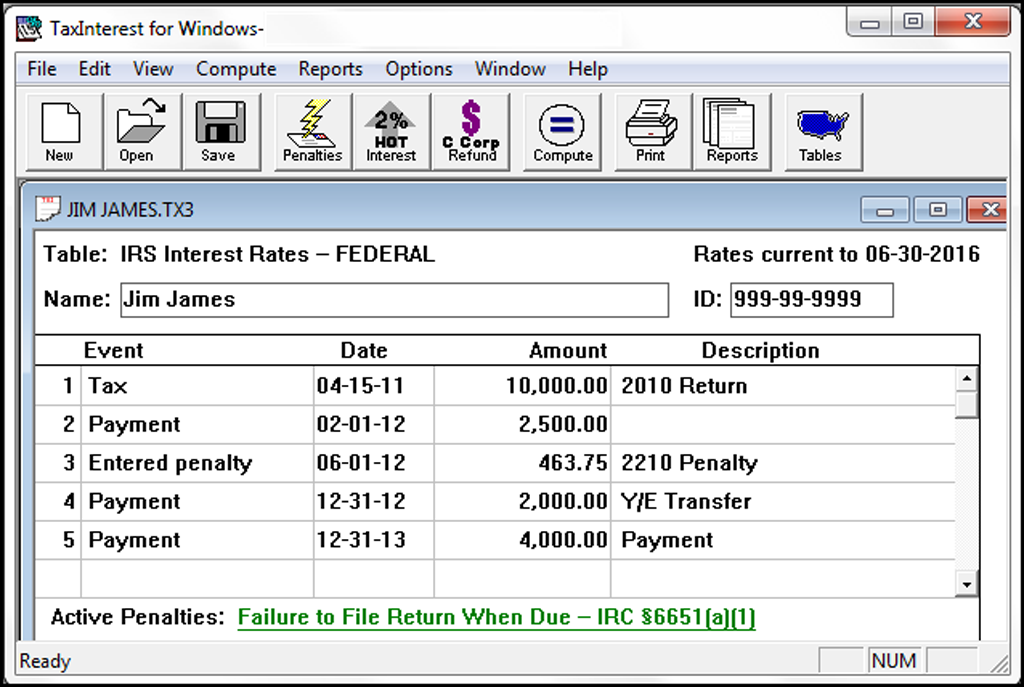

TaxInterest is the standard that helps you calculate the correct amounts. How do I fix underpayment penalty. The Failure to Pay Penalty is 05 of the unpaid taxes for.

Interest is calculated by multiplying the unpaid tax owed by the current interest rate. We work with you and the IRS to resolve issues. Underpayment of Estimated Tax Penalty Calculator.

The IRS charges a penalty for various reasons including if you dont.

Tax Penalty For Underpayment 2019 Edition Tax Relief Center Tax Help Tax Onenote Template

Taxinterest Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Income Tax Calculator Estimate Your Refund In Seconds For Free

Tax Debt Categories How Much Taxes Do I Owe The Irs

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Calculate Estimated Tax Penalties Easily

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Easiest Irs Interest Calculator With Monthly Calculation

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

California Tax Calculator State Basic Facts Tax Relief Center Basic Facts Tax California

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax